Tax Form 1098-T Information

College of the Desert distributes 1098-T forms online in individual student accounts via Self-Service or by mail to all students who have a valid tax identification number on file. For individuals, this is your social security number. This form is used to claim a tax credit for higher education. Each student's 1098-T form will be available January 31.

Desert Community College District cannot answer tax questions or offer tax advice. Please refer to your tax professional. You may not receive a 1098-T form if your tuition fees were waived by a California College Promise Grant or a K-12 fee waiver.

Help College of the Desert Go Green!

Get Your 1098-T Tax Form Online by Choosing Electronic Delivery:

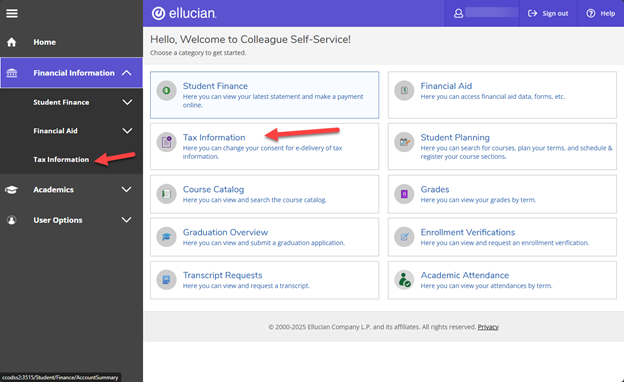

-

Go to Tax Information on Self Service and login

-

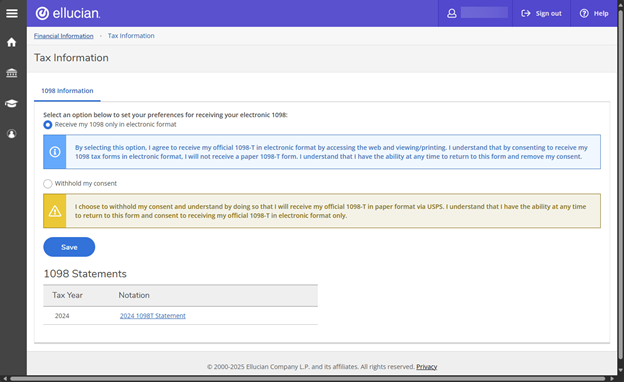

Choose ‘Receive my 1098 only in electronic format’ option

- Click Save.

To Access Your 1098-T Information:

Go to Tax Information on Self Service and login

Forgot your User Id and password?

Instructions to find your User ID and password can be found on the MyCOD page.

How Do I Get Additional Information?

Questions concerning the Hope Scholarship and Lifetime Learning Tax Credits may be directed to your tax advisor or your local IRS office.

The 1098-T information is available for students to access on demand via their Self-Service account.

From IRS.gov:

Education Credits - American opportunity tax credit (AOTC) and the lifetime learning credit (LLC)

Tax Benefits for Higher Education

Updating Personal Information

Address changes are done online on the “User Profile” page in COD’s Self-Service.